[ad_1]

The French authorities launched a program earlier this 12 months to

promote electrical automotive adoption amongst low-income households, however the

overwhelming response exceeded provide. This system provided leasing

choices and subsidies, contributing to elevated electrical automobile

gross sales. This system features a carbon footprint incentive penalizing

batteries produced in international locations with carbon-intensive grids.

The unique initiative provided leasing choices for 25,000

European-manufactured EVs at a month-to-month fee of €100-€150, with out a

deposit. Nevertheless, the response was overwhelming, with 90,000

functions obtained inside weeks, surpassing the obtainable

provide.

This system aimed to make EVs extra accessible by offering

subsidies of as much as €13,000 per qualifying EV and reasonably priced leasing

choices. Eligibility standards included a most taxable family

earnings of €15,400 per individual and a retail value restrict of

€47,000.

Initially, the federal government allotted €1.5 billion for 20,000

leases, however owing to the excessive demand, it elevated the quantity to

50,000. Nevertheless, officers halted the scheme in 2024 with

expectations that it’s going to resume in 2025.

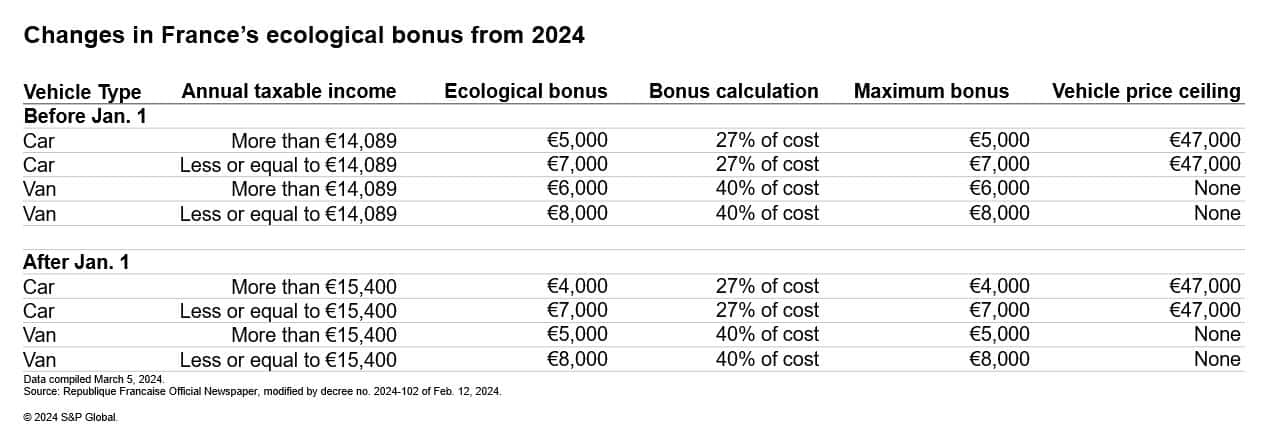

This system is an extension of France’s “bonus ecologique” and

has contributed to an enormous enhance in EV gross sales within the nation. The

authorities has since introduced a 20% discount in subsidies for

higher-income automotive consumers of electrical and hybrid autos, aiming to

stop funds overruns. This choice has raised considerations about

potential declines in registrations, much like what occurred in

Germany.

Though the ecological bonus has been instrumental in boosting

EV gross sales, the latest subsidy reduce has sparked opposition from some

calling for the necessity for elected officers to prioritize the

ecological transition.

Ali Adim, senior analysis analyst for batteries at S&P

International Mobility, stated: “One of many progressive options of the

ecological bonus is its consideration of the carbon footprint of

automobile parts, resembling batteries. This incentive not solely

targets the curtailment of tailpipe emissions by selling EVs, however

it additionally goals to decrease emissions throughout the manufacturing part. EVs

are related to considerably increased manufacturing emissions than

inner combustion engine (ICE) automobiles because of their heavy and

carbon-intensive battery packs. The brand new incentive mechanism in

France immediately addresses this hole and will function a task mannequin

for future laws in different international locations and areas. Making use of a

carbon footprint threshold to EV parts (batteries) may have

a number of implications. Batteries produced in international locations with extra

carbon-intensive grids will probably be penalized. Because of this, all Chinese language

automobile fashions have been disqualified for the eco-bonus final 12 months.”

S&P International Mobility’s Battery Carbon Footprint forecast

exhibits that the typical carbon footprint of batteries produced in

China in 2023 was 72 kgCO2-eq/kWh, increased than Europe’s 51

kgCO2-eq/kWh.

Diana Quezada, senior analysis analyst for EV charging at

S&P International Mobility, agrees that the federal government’s incentives

have been key in encouraging the set up of EV chargers, given

their preliminary low return on funding to the cost level

operators. “Nevertheless, it will change with the rising mass

adoption of EVs in France, which is pushed by the expansion within the EV

charging community throughout the nation. To this finish, the French

authorities’s Advenir program stays strategically essential because it

targets firms and communities eager on investing in EV charging

infrastructure, particularly the publicly obtainable EV chargers

put in on the roads.”

Writer:

Amit Panday – Senior Analysis Analyst, Provide Chain &

Expertise, S&P International Mobility

To learn our detailed perception on the

France EV coverage for 2024, click on right here.

This text was revealed by S&P International Mobility and never by S&P International Scores, which is a individually managed division of S&P International.

[ad_2]