[ad_1]

Take heed to this Gas for Thought

Podcast

Uncover Insights from S&P International’s Report:

Reinventing the Truck 2023

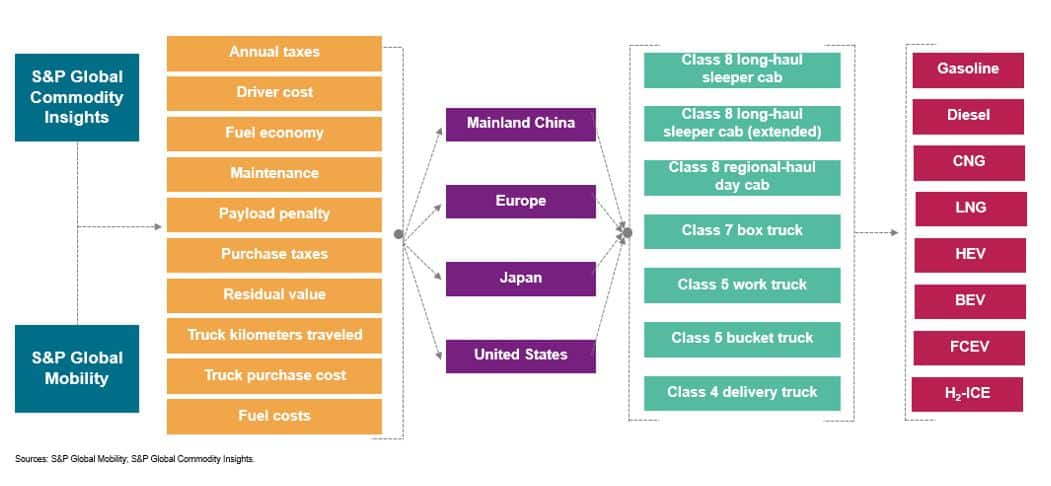

All over the world, disruption is coming to the medium and heavy

business car (MHCV) trade. An elevated deal with local weather

change, strict rules, and technological improvements are

anticipated to alter the way forward for this trade. Within the 2023

Reinventing the Truck (RTT) replace, consultants from S&P International

Mobility and S&P International Commodity Insights have partnered to

determine and tackle main questions dealing with the trade. This

report navigates a panorama in flux. Rising optimism for

electrified automobiles is weighed towards the backdrop of sensible

challenges. S&P International’s scenario-based strategy strives to

strike a fragile stability between the 2. Updates this 12 months focus

on improved prospects for pure gasoline and hybrid vehicles and

challenges across the infrastructure buildout for the MHCV vitality

transition, amongst different issues.

Background

As governments worldwide rely upon zero-emission automobiles (ZEV)

to satisfy local weather and vitality objectives, trucking will undoubtedly play a

important function within the upcoming vitality transition. Although medium

and heavy business vehicles represented lower than 4% of on-road

car gross sales in 2023 (excluding three-wheelers), in response to our

Commodity Insights Staff, they account for 39% of highway transport

liquids demand and 40% of on-road CO2 emissions, respectively. This

report examines the influence of modifications in know-how and rules

on truck demand, propulsion developments, powertrain shifts, vitality

demand, and regional local weather objectives over the subsequent three a long time. It

focuses on mainland China, Europe, Japan, and the USA.

The RTT report presents two forecast situations to 2050: Inflections

and Inexperienced Guidelines. Inflections represents a continuation of the

establishment, the place balancing decarbonization ambitions should be

weighed equally towards adoption constraints. Inexperienced Guidelines, on the

different hand, is an alternate state of affairs that envisions a robust

vitality transition pushed by elevated deal with local weather change and

technological developments. On this state of affairs, the clear vitality

revolution transforms the MHCV gasoline combine.

Inflections: Balancing MHCV decarbonization ambitions

with sensible challenges

- All over the world the adoption of battery-electric and fuel-cell

electrical MHCVs varies in tempo, and catalysts for change will happen

step by step. - In some markets, the zero-emission car (ZEV) gross sales share is

anticipated to speed up in contrast with forecasts printed 12 months

in the past. - Diesel alternate options will lengthen past ZEVs, with pure gasoline

and hybridization additionally anticipated to contribute to the long run

powertrain combine. - Draw back dangers to the ZEV forecasts are thought of, and any

modifications within the political panorama and proposed rules are high

of thoughts. - Authorities insurance policies and initiatives jump-start funding

exercise, however their success will not be but sure.

Inexperienced Guidelines: A clear vitality revolution transforms the

MHCV gasoline combine

- Market forces and funding exercise sign important

acceleration in zero-emission alternate options. Governments will

proceed to help the vitality transition with new funding

alternatives mixed with the implementation of recent

rules. - International locations all over the world vigorously pursue the vitality

transition to create a aggressive edge within the world

market. - Elevated demand for clear know-how will immediate a sturdy

market response, resulting in elevated provide and decrease costs. - OEM investments and trade innovation strongly pivot towards

ZEVs.

Further insights into the brand new questions we answered and

drivers of change established within the newest RTT report are included

beneath. We additionally supply a glimpse into key outcomes from the long-term

forecast and talk about our monitoring of vitality transition signposts,

highlighting the important thing conclusions of this 12 months’s report, which is

now obtainable for subscribers.

Exploring catalysts for change and answering new

questions

Annually, as we talk about a brand new Reinventing the Truck research, we

mirror on key developments and milestones from the previous 12 months.

We additionally anticipate looming developments and catalysts for change which are

on the horizon, this 12 months’s report was no exception.

- Options resembling pure gasoline and most notably hybrid

electrical automobiles (HEVs) present increased forecasts in contrast with

earlier RTT studies. The gross sales share of HEVs elevated on account of

sturdy strain to adjust to upcoming rules, considerations about

potential battery uncooked materials shortages, excessive prices of ZEVs and,

in lots of instances, underdevelopment of the ZEV ecosystem. - Battery value ({dollars} per kilowatt-hour) forecasts in our MHCV

TCO have been elevated. The TCO forecast makes use of notably increased

battery prices in contrast with final 12 months’s research. Potential scarcity

of uncooked supplies, lack of economies of scale, competitors with the

Gentle Automobile market, and uncertainty with long-term partnerships

are foremost causes for this new value assumption. Nonetheless, regional

variations are essential to notice, we count on decrease battery prices in

mainland China in comparison with different markets. - Prices or financial savings of the ZEV adoption have been carefully examined,

figuring out main challenges and signposts. OEMs can’t afford to

subsidize the acquisition prices of ZEVs. Help to alleviate value

burdens can be a key signpost to trace. Authorities help and

probably increased prices for finish customers will assist offset these

elevated bills. - Rules in Europe and the USA are complicating

operations and strategic selections for world OEMs. Current modifications

goal to advertise cleaner diesel vehicles and electrification, however they

include further prices and complexity for inner combustion

engines (ICEs) and the broader ecosystem. - In some areas of the worldwide truck market, the ZEV gross sales share

within the Inflections state of affairs is predicted to speed up in contrast with

forecasts printed 12 months in the past. Quite a lot of new product

launches, the introduction of recent regulatory insurance policies and the

launch of initiatives targeted on supporting decarbonization are all

causes for this improve. Nonetheless, you will need to level out

that these will increase are considerably focused, with the largest coming

within the late 2020s and early 2030s led by battery-electric automobiles

(BEVs) and fuel-cell electrical automobiles (FCEVs) within the United Sates

and Europe. By 2050, the will increase are much less noticeable in favor of

a extra optimistic view on hybridization and pure gasoline in contrast

with final 12 months. - Funding in ICE and corresponding enhancements in gasoline

effectivity differ by state of affairs. Within the Inexperienced Guidelines state of affairs, OEMs

considerably abandon their funding in ICE know-how, leading to

two outcomes. First, OEMs rely nearly solely on ZEVs to conform

with upcoming rules. Second, this development accelerates the overall

value of possession (TCO) parity between zero-emission automobiles and

ICE automobiles. - Signposts are documented and are key to the ZEV adoption in

every state of affairs. This research assesses key signposts within the Inflections

and Inexperienced Guidelines situations. It additionally evaluates mandatory developments and

developments required for these forecasts to materialize,

encompassing the monitoring of prices, product availability,

rules, infrastructure deployment and different pertinent

components. - The infrastructure for battery-electric and hydrogen-powered

vehicles is advanced and requires important funding. The report

offers insights into the challenges of zero -emission MHCV

infrastructure and presents potential situations for its

implementation. As an illustration, by 2030, the US might have to have

60,000 to 100,000 MHCV chargers obtainable to accommodate our BEV

forecast, relying on charger utilization. Within the 2040s, the US is

projected to have one of many largest hydrogen trucking fleets in

the world. To reduce prices, will probably be important to maximise the

utilization of hydrogen refueling stations. By the top of this

decade, an estimated 4,000 to 11,000 hydrogen refueling stations

will likely be wanted for MHCVs within the US, relying on station

utilization.

The TCO forecast is central to the Reinventing the Truck research.

It offers detailed insights and allows extra knowledgeable long-term

powertrain forecasting. Given the slim revenue margins in lots of

sectors of this trade, market members are extremely delicate

to modifications in the associated fee construction of their purchases.

The scenario-based strategy can be evident within the whole value of

possession modeling and forecasting. Within the Inflections State of affairs,

which – represents a continuation of the established order, – the associated fee and

availability of recent know-how step by step enhance all through the

forecast horizon, however value stays a big barrier to

adoption all through the mid-term. Conversely, within the Inexperienced Guidelines

State of affairs, market forces and funding developments favor

decarbonization, leading to speedy enhancements in value and

availability. A tipping level is reached the place the price of new

know-how considerably drops, making zero -emission alternate options

the extra economically viable answer. A commonality between the

two situations is that now we have not noticed any indicators indicating a

important discount in the associated fee outlook for zero -emission

know-how or zero -emission vehicles in comparison with our view from 12

months in the past. Restricted economies of scale, growing provide chains,

and an general underdeveloped ecosystem counsel that prices will

proceed to stay excessive within the fast future. Staying on the

subject of signposts, qualitative evaluation in areas like

partnerships and know-how pathways performed a pivotal function in

evaluating the long run value metrics of electrified vehicles.

Key takeaways embody:

- Totally different MHCV segments will seemingly undertake numerous battery

chemistries primarily based on working wants.

- Strategic sourcing selections by OEMs and suppliers will likely be a

cornerstone of their electrification plans. - Early indicators counsel that MHCV OEMs are leaning in direction of

partnering and outsourcing all points of battery procurement,

sturdy partnerships are anticipated to emerge. - International OEMs proceed to take a position and take a look at hydrogen know-how

and, -OEMs are creating partnerships to take a position sooner or later. - In each situations, a twin ZEV technique is predicted to emerge;

as OEMs improvement BEVs and hydrogen powered vehicles. - In keeping with the TCO forecasts, prices develop in a different way for

completely different vocations and in several areas.

Fueling the way forward for the business truck

market

Assessing midterm and long-term powertrain forecasts depends on

key pillars, together with the regulatory setting, whole value of

possession forecasts, and trade signposts resembling product

availability and funding developments. Attaining a stability between OEM

expectations, authorities ambitions, and S&P International analysis and

evaluation is an important a part of the RTT forecasts.

Within the RTT markets—mainland China, Europe, Japan, and the

US—short- to midterm gross sales developments will likely be influenced by world

financial and geopolitical components, in addition to impending rules

that might alter shopping for patterns. Lengthy-term, progress in truck gross sales

will likely be partly offset by a modal shift in freight motion,

elevated effectivity within the trucking ecosystem and, in sure

markets, a barely weaker financial outlook. Because it pertains to

powertrain modifications, over the previous 24 months there was

important momentum to decarbonize the trucking trade, with

various ranges of motivation throughout completely different areas. For these

extra acquainted with the sunshine car market, trucking stands out

for its significance to the worldwide economic system by its motion of products

and the expectation of a future with two distinct zero-emission

choices: battery-electric and hydrogen. Additionally it is essential to

observe that cleaner alternate options resembling pure gasoline vehicles and

hybridization shouldn’t be disregarded. The adoption of

zero-emission and electrified vehicles will transfer at completely different speeds

throughout completely different regional markets. Key messages that inform the

long-term powertrain forecast are famous beneath.

- Mainland China’s transition in direction of a

completely different gasoline and propulsion combine will likely be propelled by authorities

rules, insurance policies, and investments geared toward decreasing reliance

on fossil fuels and assembly local weather goals. Battery-electric

vehicles are poised to grow to be a most popular answer on account of favorable

TCO economics in comparison with ICE vehicles. Mainland China advantages from

its giant market measurement and robust authorities help for growing

the ZEV ecosystem. In each situations, the convergence of low

battery prices, reasonably priced manufacturing, and the inefficiency of

diesel vehicles permits numerous truck vocations to rapidly obtain

parity in TCO between battery-electric automobiles and diesel.

In comparison with our view from 12 months in the past, the absence of recent, extra

stringent rules and different indicators means that the

forecast for electrified vehicles in mainland China stays largely

unchanged. The adoption of zero-emission vehicles is predicted to

step by step strengthen as the general ZEV ecosystem improves.

- Europe’s bold aim to decarbonize the

transport sector ranks among the many strongest globally. Nonetheless,

preliminary adoption is predicted to be considerably modest in our

Inflections state of affairs as impending rules and coverage targets

start to take form within the late 2020s and into the 2030s. Europe’s

CO2 discount rules will closely affect mid- to

long-term powertrain forecasts, with compliance various throughout

completely different situations. These forthcoming rules are anticipated

to considerably influence the way forward for this market. In comparison with our

view final 12 months, the electrification outlook by way of the early 2030s

will stay largely unchanged, regardless of a notable improve within the

gross sales share of HEVs. Moreover, an elevated outlook for

electrified vehicles within the 2040s is predicted on account of OEMs adhering to

anticipated EU CO2 discount rules. Within the Inexperienced

Guidelines state of affairs, ZEV gross sales are projected to see a big

improve to satisfy regulatory necessities. - Japan displays a sturdy dedication to

hydrogen, evident within the involvement of key OEMs resembling Toyota,

Honda, Isuzu, and Mitsubishi, all engaged in numerous ranges of FCEV

funding and product launches. As well as, a number of OEM

partnerships are rising in Japan and the influence of recent

partnerships available on the market could be interpreted in numerous methods.

Collaboration, cost-sharing, and any efforts to reinforce economies

of scale could be considered as a optimistic for the market. Nonetheless, with

lack of aggressive rules or ZEV mandates, adoption of BEVs

and FCEVs on this market will likely be decrease in contrast with different RTT

markets. Nonetheless, within the Inexperienced Guidelines state of affairs, improved TCO

economics of ZEVs will likely be sufficient to drive important demand within the

mid to long-term forecast horizon. Within the Inflections state of affairs, two

main drivers of ZEV progress are absent: stringent rules and a

TCO construction that may encourage increased ZEV adoption. - United States market modifications could be seen as

coverage pushed. In recent times, the present administration has

proven a steadfast dedication to decreasing and probably

eliminating emissions from the transportation sector. The passage

of a number of giant spending payments, incorporating local weather change

initiatives, coupled with the introduction of recent rules has

escalated the strain on the trade to scale back emissions to

unprecedented ranges. Nonetheless, there are important draw back dangers

to contemplate. Uncertainties round vitality prices and product prices

loom giant, as do home and worldwide political dangers, which

may influence public help or uncooked materials availability, for

instance.

General, the uptake ZEVs within the US will observe this development; first

demand will likely be pushed by the regulatory setting and subsidies

earlier than TCO of ZEVs reaches parity with ICEs. Within the US, the

Inflections state of affairs means that the market will expertise a

twin technique to impress the trucking trade. Rising

strain to adjust to imminent rules and initiatives

stemming from the IRA are driving components behind the rise in gross sales

of HEVs and FCEVs, respectively.

The long-term influence on oil demand

The adoption of different energy sources for medium and heavy

business vehicles will considerably influence your complete logistics

ecosystem and economies worldwide. Oil demand will likely be a metric

severely affected. Past the apparent uptake of ZEVs, a number of

components contribute to the decline in oil demand. It is essential to

emphasize that no single motive independently drives demand down;

moderately, it is the cumulative influence of a number of components resembling:

- The continued enchancment in gasoline effectivity of diesel-powered

vehicles. We’re in an period particularly within the US and Europe, the place

tightening emission rules will drive OEMs to spend money on extra

fuel-efficient know-how. - Developments within the trucking and logistics ecosystem are

anticipated to reinforce trade effectivity placing downward strain

on the demand so as to add vehicles to the fleet. - In the long run, progress in truck gross sales will likely be partly offset

by a modal shift in freight motion towards different modes of

transport resembling rail or water. This development will likely be significantly

evident in Europe and mainland China. - Trucking forecasts are carefully tied to financial efficiency in

their native markets. Any slowdown in common gross home product

(GDP) progress might adversely influence demand so as to add new vehicles to the

fleet.

Conclusion

The Reinventing the Truck report unveils two believable situations

amidst a altering panorama. The completely different state of affairs storylines

unfold narratives of how the long run market panorama will evolve

and the way clear vitality know-how will rework the MHCV gasoline combine.

Every perception within the report emphasizes a constant takeaway: change

is inevitable.

The report is

obtainable now for subscribers.

Please

contact us for extra data on the newest Reinventing the

Truck report!

————————————————————–

Dive deeper into these mobility insights:

Acquire a brand new perspective on the

business car market with Fleet Intelligence

Get a free Truck Mannequin Manufacturing

Forecast from S&P International Mobility

This text was printed by S&P International Mobility and never by S&P International Rankings, which is a individually managed division of S&P International.

[ad_2]