[ad_1]

Abstract

The US Environmental Safety Company (EPA) rules

launched on March 20, 2024, appear designed to drive towards a BEV

answer, although the company does describe the rule as “know-how

agnostic,” a number of parts appear basically designed to

encourage the battery electrical car answer for zero-emissions

autos.

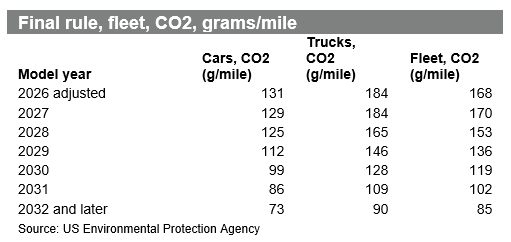

- Mild-duty CO2 rules nonetheless have an identical finish

level for the 2032 mannequin yr. Necessities for mannequin years

2027-2030 are simpler than the company proposed in April 2023 and

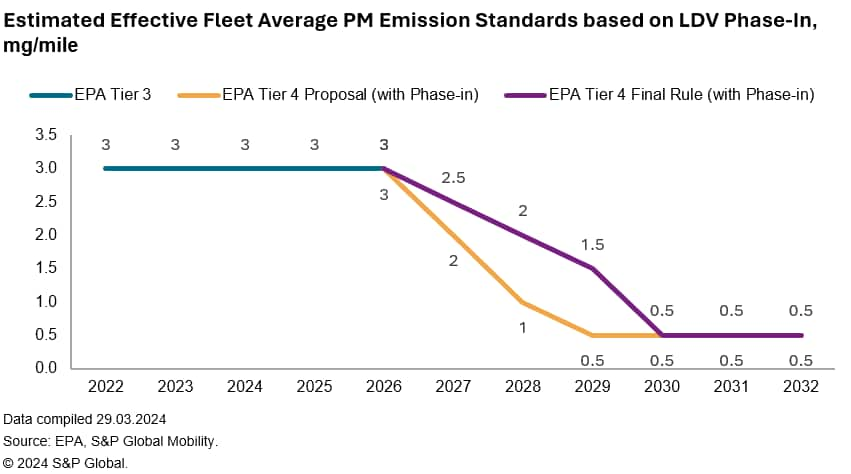

nonetheless harder than earlier guidelines. - Tier 4 regulation of particulate matter and different vital

emissions (NOx, and so on) have strict finish goal, additionally eased from the

April 2023 proposal and are extra strict in 2031 and 2032. To fulfill

these necessities, it’s our evaluation that primarily any

car with an engine–hybrid and PHEV included–will require a

particulate filter to seize particulate matter and be compliant

by 2032 mannequin yr. - The Division of Vitality has additionally up to date the calculation for

figuring out the eMPG equal for battery electrical autos. The

revision was largely designed to make sure BEVs contribute much less in

eMPG. This transformation will have an effect on NHTSA calculations for gas economic system

compliance quite than GHG emissions. It’s going to make it more durable to make use of

minimal BEV gross sales to offset ICE car gross sales, additional encouraging

gross sales of BEVs. - The EPA has maintained the averaging, banking and buying and selling of

credit, in addition to the carry-forward and carry-backward

provisions; the April 2023 proposal had not beneficial any

change. - When it comes to off-cycle credit and credit score menu gadgets, it was

finalized that BEVs don’t get credit for gadgets that scale back gas

consumption however should not captured within the fuel-efficiency or

emissions check cycles. This was anticipated; as a BEV doesn’t burn

gasoline or diesel gas to function, permitting a BEV to get the

credit score may create a scenario the place a BEV had a unfavourable GHG

compliance worth. Off-cycle credit can be found solely to autos

with tailpipe emissions better than zero. - The EPA maintains the footprint-based construction, grouping

autos and anticipated emissions by dimension, although the calculations

have been adjusted to scale back the probability for producers to

change the dimensions or regulatory class of autos as a compliance

technique.

New rules properly obtained

The ultimate ruling has, on the whole, been well-received by the

trade. As famous, it permits for a extra gradual ramp-up in BEV

in comparison with the earlier base proposal. Nonetheless, the extra gradual

ramp additionally implies that within the final two mannequin years, the necessities

have a steeper drop. Automakers might want to work towards a extra

aggressive catch-up within the final two mannequin years.

GHG / CO2 implications

The EPA doesn’t mandate what propulsion system is used, although

they do estimate what mixture of battery electrical, plug-in hybrid

electrical, hybrid electrical, or inside combustion engines may

meet the goal, primarily based on EPA calculations. With the ultimate ruling,

the EPA illustrated three main pathways to achieve compliance,

demonstrating what sort of combine an automaker may use to achieve

compliance. These EPA pathways should not directives, and automakers

can use a distinct combine to be compliant, however the pathways offered

present some perception into potentialities.

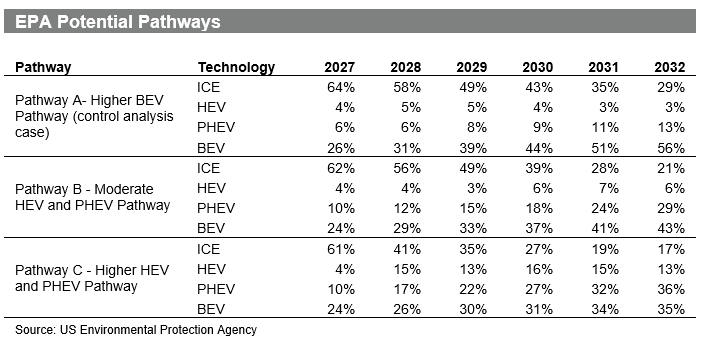

Beneath EPA’s three potential pathways, the estimated BEV charge to

attain compliance varies considerably. Pathway A sees EVs as excessive

as 26% in 2027 mannequin yr as a technique ahead to assembly compliance.

Every pathway considers a distinct mixture of full hybrid and plug-in

hybrid options working with BEV options. We discovered it

attention-grabbing that the pathway eventualities which the EPA illustrated

every included a heavier PHEV penetration than the proposal. In

these EPA illustrations, an assumption is made to see HEV at

roughly half the 8.6% share it had in January 2024 (in line with

S&P World Mobility light-vehicle registrations) in 2027 mannequin

yr. These illustrative pathways even have PHEV at greater than three

occasions penetration in January 2024 (2.5%) as quickly as 2027 mannequin

yr. These are merely illustrations of what the market may look

like however are seemingly indicative of what the EPA expects might be

viable. One other factor of differentiation for these remaining guidelines

versus earlier guidelines is that light-duty vans, which incorporates

most utility autos, are challenged to scale back emissions by 51%

whereas passenger automobiles are anticipated to see a 44% decline in

emissions.

The three pathways that the EPA offered put the US market at

between 35% and 56% BEV gross sales in 2032 mannequin yr. That is additionally a

vital change from the April 2023 proposal which may have

put BEV penetration in 2032 at 67% of the US light-vehicle market.

These pathway illustrations additionally work to exhibit it would nonetheless

be executed even when the US market doesn’t attain the 50% BEV gross sales

which President Joe Biden has set as a smooth goal for 2030

calendar yr, whereas additionally suggesting that the EPA sees PHEV because the

extra viable interim answer than its prior evaluation recommended.

That change may see Stellantis modify its plans for PHEVs inside

its new multi-energy platforms, whereas Mercedes-Benz and BMW provide

PHEVs and should have the chance to regulate the combo as properly.

Hyundai Motor Group additionally could also be able to additional refine its

PHEV know-how and place extra significance there. Toyota has to this point

put extra effort behind HEV, although it does even have sturdy PHEV

know-how it may place extra emphasis on. Lastly, this might imply

Ford and GM take a better have a look at PHEVs as an answer to achieve

compliance if BEVs do not take off as quickly as deliberate.

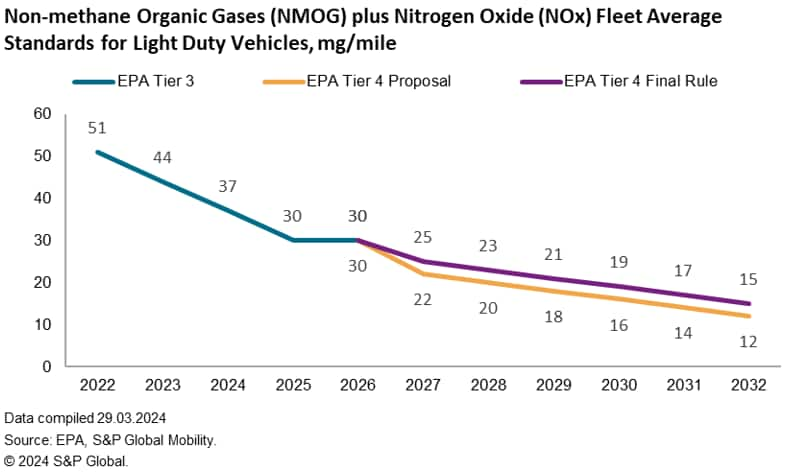

Tier 4: Non-methane natural gases (NMOG) and nitrogen

oxide (NOx) requirements

The rules additionally tackle particulate matter and different

standards pollutant emissions in non-methane natural gases (NMOG)

and nitrogen oxide (NOx), that are emissions from all

internal-combustion engines. These requirements have to be met by

multi-fueled autos as properly, on every gas which is used. Right here,

too, the ultimate rule is much less onerous than the proposed rule, although

nonetheless requires a 50% discount in these emissions.

With the ultimate ruling, the trade request for PHEVs to obtain

an adjustment as a result of they will run on electrical energy solely was

declined. These requirements are required to be met by multi-fueled

autos on every gas that’s “consumed.” For PHEVs, meaning

that the requirements must be achieved each on electrical energy alone

(charge-depleting operation) and gasoline (charge-sustaining

operation). Consequently, we count on that PHEVs wouldn’t be exempt

from assembly these rules and are prone to additionally must

embrace particulate filters. The stress right here has the potential to

make PHEVs a dearer answer than a BEV, in some instances.

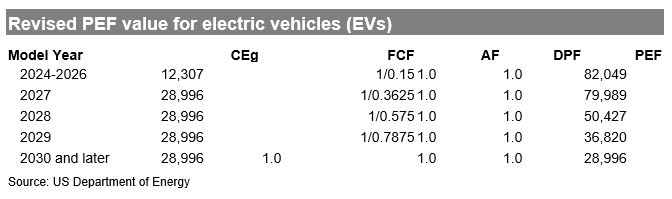

Division of Vitality Petroleum-Equivalency

Issue

The US Division of Vitality (DoE) has issued its remaining ruling on

updating the Petroleum-Equal Issue (PEF). This issue is used

within the EPA and Nationwide Freeway Visitors Security Administration

(NHTSA) calculation for figuring out the impression of EVs on a

light-duty automakers compliance with the Company Common Gasoline

Financial system (CAFE) requirements. This issue primarily determines the

extent to which the sale of an EV could offset gross sales of inside

combustion engine autos. Autos with excessive eMPG contribute to

an automaker’s compliance with CAFE requirements, administered by

NHTSA and aligned with the EPA emissions requirements. By lowering the

eMPG an automaker can declare for a BEV, it means the automaker

can’t use that top eMPG car to functionally offset a low MPG

car which is out of compliance. The ultimate rule has been

positioned as a win for automakers as a result of it reduces the PEF EV

gas economic system score by 65% starting in 2030, as an alternative of a 72%

discount beginning in 2027 mannequin yr, as initially proposed; this

may give automakers extra time to regulate to the change. Nonetheless,

as with the opposite regulatory parts introduced this week, this

change introduces additional stress on automakers to shift to

battery electrical autos as a zero-emissions answer by lowering

the flexibility of BEV to offset a number of ICE gross sales. The win is in that

the issue doesn’t go down as quick as earlier proposed and allows

a barely slower stroll to the 2032 targets.

S&P World Mobility Preliminary Outlook

Our present February 2024 forecast already components in a

regulatory setting expectation that was much less aggressive than

the EPA’s base proposal from final April. Subsequently, it is untimely

to notice if any materials powertrain adjustments will must be

included. Future forecast rounds shall be up to date to replicate any

mandatory adjustments, notably at a car degree.

The ultimate rule has an identical endpoint to the proposed rule,

although the 2027 to 2030 mannequin years are much less stringent than the

EPA’s base proposal from April 2023. This has, on the whole, been

properly obtained by trade. The ultimate rule permits for a extra gradual

ramp up in BEV in comparison with the earlier base proposal. This may

permit extra time for customers to adapt to the know-how,

infrastructure to develop, and effectivity enhancements within the legacy

ICE powertrain options. That is welcome information to S&P World,

as our powertrain forecast had presumed a much less aggressive EPA

regulation, owing to OEM/vendor/union pushback in opposition to the EPA base

proposal from April 2023.

Get a free trial of

AutoIntelligence

This text was revealed by S&P World Mobility and never by S&P World Rankings, which is a individually managed division of S&P World.

[ad_2]