[ad_1]

Producer help for on-site EV charging infrastructure is rising as one of many principal areas of concern for sellers.

Based on the newest NFDA Seller Perspective Survey (DAS) which was carried out over 5 weeks between the tip of January and the beginning of March 2024 and which secured 2,321 responses from 32 franchised networks the subject of on-site EV charging infrastructure featured because the lowest scoring within the survey and highlights that there’s a lot of concern amongst sellers concerning producer help right here.

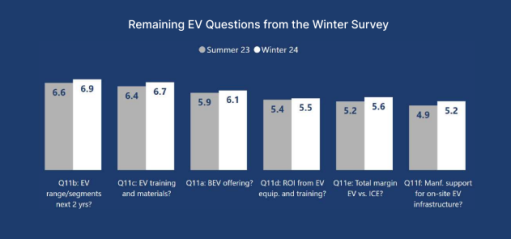

Whereas the query noticed a rating improve of 0.3 to five.2 from 4.9 within the Summer time 2023 version, a 6.1% change, it additionally noticed a number of producers drop down a number of locations from the earlier version, with Audi, Skoda, Suzuki, Cupra, and Volkswagen all dropping not less than 11 locations, highlighting that there’s a lot concern amongst sellers.

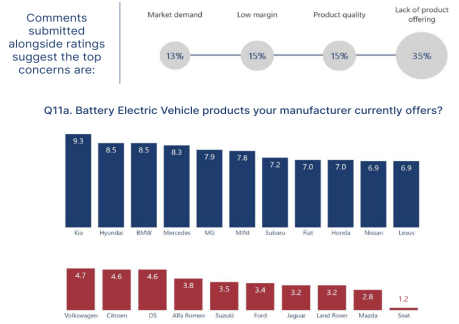

Seller satisfaction ranges for battery electrical automobiles at present provided by producers acquired a 0.2 improve to six.1 from 5.9 within the Summer time 2023 version of the survey, equating to a 3.4% change.

The best three producers rated for this query noticed Kia high with a rating of 9.3 and each Hyundai and BMW rounding off the highest three with a joint rating of 8.5. The bottom scores have been acquired by Seat (1.2) and Mazda (2.8), while Jaguar and Land Rover each acquired a rating of three.2.

Feedback submitted by sellers alongside rankings prompt issues from sellers included the dearth of product providing (35%) and product high quality (15%).

When it comes to return on funding in tools/coaching for EV and plug-in automobiles, Kia maintained the highest place for this query, receiving a rating of 8.5, equal to their rating within the earlier version.

MINI moved as much as second place receiving a rating of seven.7, while Nissan surged up the desk with a rating of 6.9 to maneuver from ninth within the earlier version to fourth on this survey. MG slid down the desk from second within the earlier version to sixth with a rating of 6.7 while Seat (2.3), Volkswagen (3.4) and Jaguar (3.8) acquired the bottom scores.

This subject acquired a median rating of 5.5, a 0.1 improve from the earlier survey which demonstrates that issues stay amongst sellers surrounding electrical automobile/plug-in automobile ROI and coaching.

When it comes to whole margin on new EV/hybrid gross sales in contrast with new ICE gross sales, the query acquired a median rating of 5.6 on this survey, a rise of 0.4 from the final version and a change of seven.7%.

Kia once more took the primary spot with a rating of 8.0, while earlier leaders MG dropped right down to sixth place with a rating of 6.6. Mercedes-Benz moved as much as second place with a rating of seven.9 while MINI accomplished the highest three with 7.6.

Abarth made appreciable floor, transferring from twenty first place to eighth with a rating of 6.2, as did Vauxhall, transferring from twenty eighth place to fifteenth with a rating of 5.9. Conversely, Hyundai dropped down the desk from eighth to 18th with a rating of 5.3, as did Mazda from eleventh to twenty seventh with a rating of 4.2.

The ultimate subject on producer’s electrical automobile charging info and coaching, was a brand new addition to the DAS and sought to seek out out from sellers whether or not coaching/info on electrical automobile charging offered by their respective producers adequately prepares clients for a profitable transition to EVs.

This query acquired a median rating of 6.2, producing a blended response from the vendor community. Kia as soon as once more acquired the best rating, with 8.7, while BMW and MINI got here second and third with 8.3 and eight.1, respectively. Seat acquired the bottom rating for this subject with 1.8, far behind Suzuki who acquired the second-lowest rating of 4.0.

Sue Robinson, chief government of the Nationwide Franchised Sellers Affiliation (NFDA), which represents franchised automotive and business retailers throughout the UK, commenting on the outcomes of the NFDA Seller Perspective Survey mentioned: “It’s optimistic to see every EV subject featured within the DAS see a common uptick in common scores. But, as soon as once more, EV subjects have been among the many lowest scoring questions with sellers involved, concerning numerous elements together with producer help for infrastructure.

“From an EV perspective, the DAS exhibits that there are actually areas the place producers can enhance their relationship with sellers similar to with help and funding.

“Many sellers have additionally famous their frustrations with the Authorities and that extra must be completed when it comes to charging infrastructure and price.

“The ZEV mandate, launched earlier this 12 months, requires OEMs to fulfill a goal this 12 months of twenty-two% of recent automotive gross sales and 10% of recent van gross sales to be zero emissions or face penalties. This goal proportion will step by step rise annually reaching 52% of recent vehicles and 46% of recent vans by 2028.

“As such, producers should heed the issues of their respective dealerships as illustrated within the DAS. A more in-depth manufacturer-dealer relationship notably concerning electrical automobile coaching and help will in flip be extraordinarily helpful for shoppers in the course of the UK’s transition to electrical.

“NFDA’s Electrical Car Accredited (EVA) accreditation scheme has been important throughout this transition. EVA was developed in 2019 to recognise retailers’ excellence within the electrical automobile sector and final 12 months surpassed the milestone of 500 accredited websites.”

[ad_2]