[ad_1]

Because the world awoke on the morning of March 26 to the information that

there had been a crash involving a container ship and the Francis

Scott Key Bridge within the metropolis of Baltimore, which had precipitated the

bridge to break down, rapid ideas have been for the protection and

welfare of all involved. Six persons are lacking, presumed lifeless in

the tragic aftermath.

Site visitors by the port will probably be suspended till additional discover and

seems to be set to disrupt to commerce and provide chains. One of many sectors

that might doubtless be affected is automotive, notably after the

disclosure that the Baltimore port is the largest single hub for

commerce in mild autos within the US. Will the occasions at Baltimore be

the most recent exogenous provide chain shock to affix a protracted checklist of

occasions to disrupt the sector for the reason that 2011 Fukushima nuclear

catastrophe?

To aim to deal with this query, we undertook an evaluation of

latest commerce knowledge for autos and components supplied by Panjiva, a

product of the S&P World Market Intelligence division. Our

automobile evaluation focuses from the Jan. 1, 2024, to Jan. 31, 2024

time interval to provide a snapshot of car tradeflows into the US.

Utilizing the Harmonized System (HS) code 8703, which pertains to vehicles

and motor autos primarily designed for private transportation, we

scrubbed the info for merchandise exterior of the light-vehicle sphere,

resembling golf carts and all-terrain autos (ATVs), and used

autos.

This course of confirmed Baltimore’s crown because the main port for

automobile motion within the US. Within the interval into account, it

accounted for 15.2% of car commerce, almost 5% forward of its

nearest rival Brunswick, Ga. By way of imported automobile commerce by

weight, Baltimore’s determine of almost 117,000 tons equates to just about

63,000 autos based mostly on the typical weight of latest autos within the

US, based on an Environmental Safety Company (EPA) examine of

2022.

Delving deeper into knowledge for Baltimore and consignees

(these receiving the products) based mostly simply in North America —

leaving out these autos the place Baltimore is only a stopping-off

level earlier than heading additional afield to international locations resembling Australia,

New Zealand or South Korea — it’s seen that Mazda is the

greatest buyer of the port by way of automobile commerce. Mazda first

signed a five-year contract with the Port of Baltimore again in

August 2013, making the port the hub for its northeastern

distribution.

Impression on provide chain

The extent of disruption precipitated to automobile shipments by Baltimore’s

shutdown is predicted to be minimalized by a large number of different

choices being obtainable to automobile firms eager to route their

autos to the US’ east coast. Brunswick; Newark, NJ; and

Philadelphia all present viable alternate options.

Additional hope that offer chain disruption will probably be minimal is

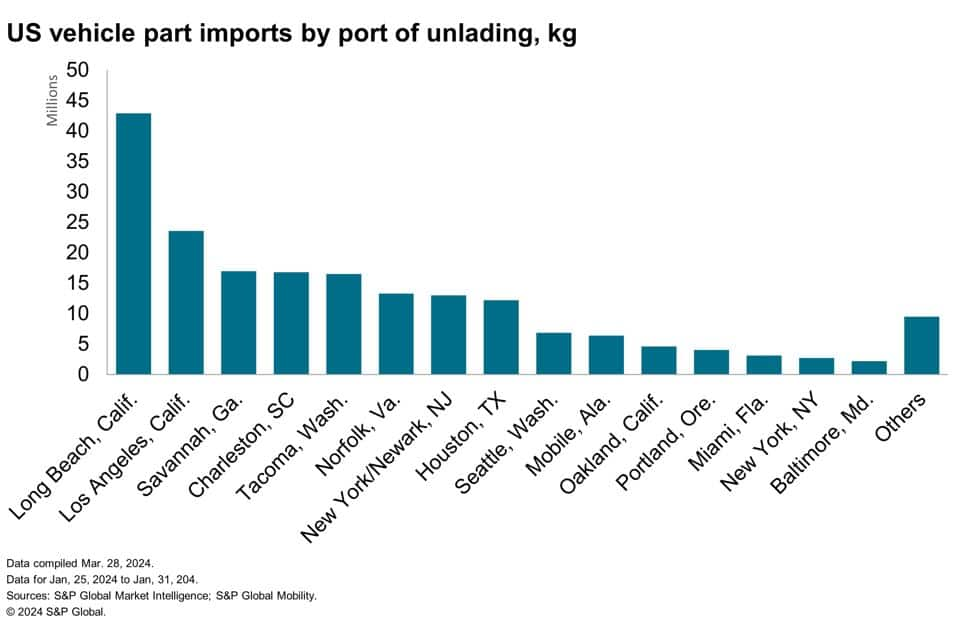

supplied by diving into Panjiva’s knowledge on motorized vehicle components (HS

8708 for these ). Analyzing the commerce knowledge for a one-week

interval in January 2024 reveals that Baltimore is a a lot much less

vital participant on the subject of unique tools (OE) and

aftermarket components. Right here, Baltimore sits fifteenth within the checklist of US

ports and had only a 1.1% share of motor half site visitors within the

week.

The first concern for the trade will heart on whether or not any

crucial components will probably be impacted by Baltimore’s rapid closure

with knock-on results for automobile manufacturing and automobile possibility

availability. Right here, there appears to be extra excellent news for the

trade’s provide chain. Additional examination of the motorized vehicle

components knowledge referring to Baltimore doesn’t throw up any vital

dangers. A Cummins subsidiary, Cummins Cooling Merchandise Inc., is

famous because the consignee for intercoolers and cost air coolers

shipped from mainland China. Elsewhere, a consignment of Dana drive

axles from Italy is famous.

All informed, it appears truthful to say that the Baltimore port incident,

whereas bringing short-term disruption to the trade, doesn’t appear

set to roil the sector in the way in which that the COVID-19 pandemic,

semiconductors and the warfare in Ukraine have in latest historical past.

This text was printed by S&P World Mobility and never by S&P World Rankings, which is a individually managed division of S&P World.

[ad_2]