[ad_1]

Though battery-electric automobiles are getting nearer

to cost parity with their inner combustion siblings, the

affordability issue is the primary purpose shoppers are holding again

on adopting electrification, in line with a latest survey by

S&P International Mobility.

Though vary nervousness and the charging community stay causes

to hesitate, a latest world survey of shoppers confirmed that

potential EV consumers are most involved concerning the affect to their

pockets. What’s extra, this isn’t only a US-market phenomenon. It is

affecting shoppers worldwide – even in areas the place EVs have made

important market inroads.

Nearly half (48%) of the 7,500 respondents globally think about EV

costs to be too excessive, despite the fact that they perceive that the majority EVs

inherently carry a value premium.

“Pricing remains to be very a lot the largest barrier to electrical

automobiles,” in line with Yanina Mills, senior technical analysis

analyst at S&P International Mobility.

Client sentiment towards shopping for an EV has cooled significantly

over the past two years. This rise and fall are emblematic of an

immature market section, Mills mentioned. That mentioned, improved electrical

car vary, and the elevated variety of mannequin selections, have

moved down shoppers’ listing of causes to keep away from buying an

EV.

Regardless of an elevated variety of EVs obtainable, and improved

shopper consciousness of tax-credits and advantages, fewer than half of

respondents consider the EV know-how is prepared for mass market

adoption. Solely 42% of respondents are contemplating an EV for his or her

subsequent car buy and 62% of respondents are ready till the

know-how improves earlier than buying a brand new car, the S&P

International Mobility survey discovered.

How issues have modified

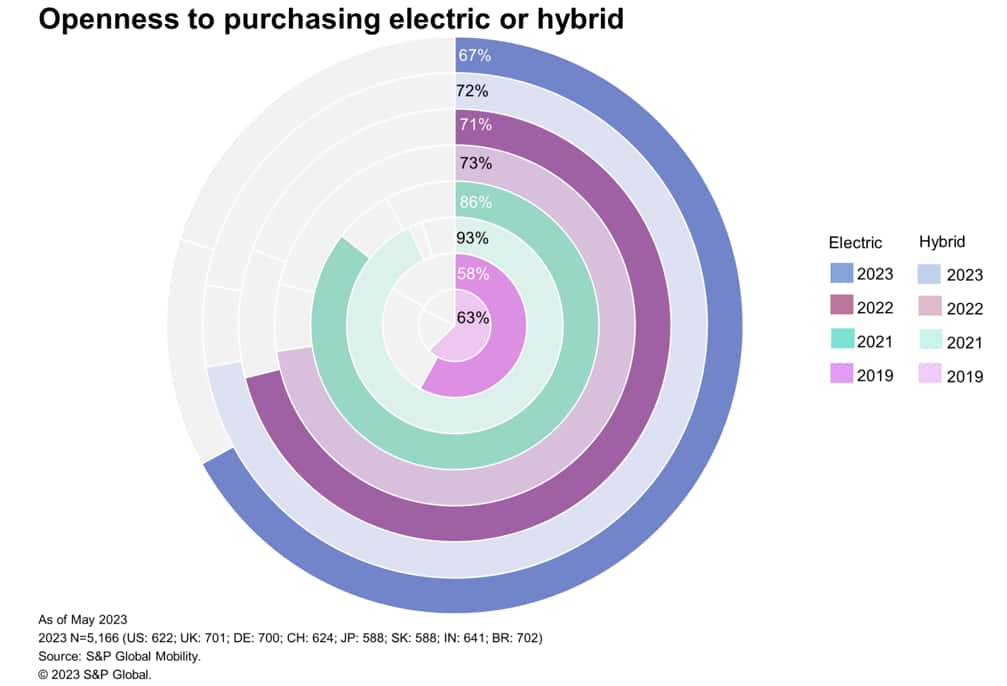

Initially, shopper curiosity was smothered by the restricted

number of obtainable EV fashions. Simply 58% of 2019 S&P International

Mobility survey respondents had been open to buying an EV, as

luxury-priced fashions dominated the early EV market. Only a handful

of mainstream fashions, just like the Chevrolet Bolt, Nissan Leaf, and

Tesla Mannequin 3, had been obtainable at the moment.

However 2021 noticed a dramatic burst of shopper EV acceptance. Purchaser

willingness soared, with 86% of worldwide respondents being open to

purchase an EV. A number of components stirred up these good emotions: New

mainstream fashions from Ford, Hyundai, Kia, and Volkswagen hit the

market. The professional-EV push within the US by the Biden administration, and

laws in a number of US states and in Europe banning future

inner combustion-engine (ICE) automobiles, additional heightened

visibility.

Whereas 67% of the 8,000 individuals surveyed in Could 2023 had been

open to the thought of buying an EV – actually increased than in

2019 – it’s a whopping 19 share level decline from 2021.

What occurred?

The final two years have introduced extra shopper alternative. These

span the far ends of the market, from hulking EV pickups within the US

to many small EV selections turning into obtainable in Europe and

China.

For one, value fatigue has set in, pushed by rising curiosity

charges and stock shortages which have solely not too long ago seen reduction,

mentioned Brian Rhodes, director of related automobile and car expertise

for S&P International Mobility.

Relying on the place an EV is manufactured, modifications to the

tax-credit program within the US now drive shoppers to lease – somewhat

than buy – many fashions. Frequent media stories about charging

community reliability shortcomings haven’t helped both. At this

level within the evolution of EVs, including extra fashions merely can not

cancel out these points.

Proudly owning an EV forces some modifications in routine. In comparison with an ICE

car, EV driving vary is usually much less. As soon as the battery

cost is depleted, it takes longer to recharge a battery than it

does to refuel a gasoline tank. Inherent EV drawbacks like these make

shoppers reluctant to purchase, particularly these often making lengthy

journeys. Nevertheless, survey outcomes present that customers settle for dwelling

with an EV’s concessions – relative to an ICE car –

post-purchase.

That mentioned, many EVs bought so far are second – typically smaller

– automobiles within the family. “For these contemplating an EV as their

main automobile, the vary/charging points are amplified since there may be

no various on longer journeys,” Rhodes mentioned.

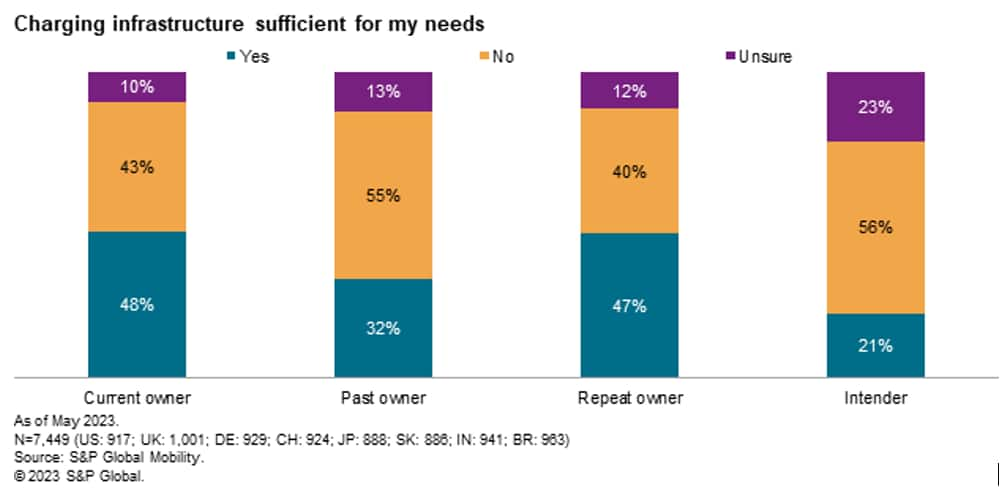

The charging community

Charging considerations are second solely to car value amongst causes

cited for these respondents in opposition to shopping for an EV. About 46% of

respondents are involved concerning the time required for charging,

whereas 44% are involved concerning the availability of charging stations

– a reversal of causes from final 12 months.

“Customers know (charging) is not going to be the usual gasoline station

in-and-out expertise,” Mills mentioned. “However they do not need to delay

for rather more time than what can be a lunch break.” Certainly, the

plurality of 2023 survey respondents mentioned they had been keen to attend

between half-hour and an hour to recharge.

Assembly this charging expectation requires

each infrastructure funding and car functionality. The one

present know-how that may assist 30-to-60-minute recharging is

quick (DC) charging, so an in depth quick charger community turns into

essential to match shopper calls for. An industry-wide shift in the direction of

utilizing Tesla’s beforehand proprietary NACS charging design ought to

speed up charging community availability if set up charges maintain

up with gross sales.

Likewise, EVs have to have high-capacity built-in chargers that

can take full benefit of quick chargers. For instance, a number of

Hyundai, Kia, and Genesis automobiles have 350kw/800V charging that

can cost a battery from 10% to 80% in 18 minutes – assuming the

charging location is working correctly.

As for the idea of battery swapping, shoppers in mainland

China, India, and Brazil proceed to be most within the

idea – with greater than 75% of worldwide respondents keen to attend

as much as half-hour for a battery swap, at a median value level of

$16.

Residence is not the place the cost is

One widespread grievance in opposition to widespread electrical car

adoption (both battery-electric, or plug-in hybrid) is that

charging is tough for homeowners who do not reside in homes and thus,

haven’t got a charger on-site. However survey outcomes reveal that this

concern could also be overstated.

Respondents confirmed that the most typical – and finest – single

place and time to recharge is certainly at dwelling, at night time. Nevertheless,

solely 42% of householders sometimes cost their electrical car this

method. Moreover, simply 51% of present and repeat EV homeowners have a

charger put in at dwelling. Whereas the {industry}’s widespread chorus is,

“Most homeowners will recharge at dwelling,” barely half of the early

adopters surveyed met that circumstance.

Seems, homeowners cost their automobiles in all kinds of

locations, together with streets, highways, and through work. Amongst EV

intenders, 25% plan to make use of public charging stations (15%).

House owners who do cost at dwelling aren’t in a rush. Most respondents

aren’t keen to pay something further (31% of respondents), or are

keen to pay a minimal 10% further (40% of respondents), to improve

to a sooner Stage 2 charger that takes 5 hours for a full

cost. Customers need quick charging on the highway, however they are going to

wait in a single day for a full cost at dwelling.

Has vary nervousness been cured?

Competing producers have pushed one thing of an EV “vary

conflict,” significantly throughout the luxurious section. The longest-range

Tesla Mannequin S claims 405 miles of vary, whereas the Lucid Air Grand

Touring promotes 516 miles. These luxurious automobiles push the envelope

in each vary and value – the Lucid stickers at almost $126,000 –

however most shoppers have extra modest wants and desires.

Most respondents indicated that they might settle for a minimal EV

vary under 300 miles. 19% would settle for a variety between 251 and 300

miles, whereas 21% can be positive with a variety from 201 to 250 miles.

Solely 29% most well-liked a minimal vary above 300 miles.

Present EV vary capabilities match this shopper demand. Nearly

each EV available on the market has a United States Environmental Safety

Company (EPA) vary of greater than 200 miles. Automobiles with an

estimated vary over 300 miles are restricted to automobiles from luxurious

manufacturers, similar to Lucid, Tesla, Rivian, BMW, and Mercedes-Benz.

Whereas present know-how could be prepared for shopper acceptance,

it doesn’t imply that customers are prepared simply but to make the leap

to an EV. 62% of respondents agreed with the assertion, “I’m

ready till car know-how improves earlier than buying a brand new

automobile.”

Requested about this disconnect, Mills defined, “There’s all the time

that little little bit of ‘What if…’ that continues to carry shoppers

again, even when for probably the most half they know they’re most likely going to

be OK with the aptitude of their new EV.”

EV buy causes stay constant

Client willingness to purchase an EV has waxed and waned over the

previous couple of years, however their causes for buy stay the identical. The

three foremost causes to buy an EV or hybrid are gasoline financial savings

(69%), environmental advantages (56%), and efficiency/driving

expertise (31%).

Electrical car advocates, together with the EPA, typically tout

downstream value financial savings as a purpose to buy an EV. Many consumers

will certainly lower your expenses on working prices, however the equation is extra

advanced. However consumers in coastal US states – the place the overwhelming majority

of EVs are bought in that market – additionally undergo from excessive

electrical energy prices, rising the price of operation for charging at

dwelling.

In the meantime, whereas some free Stage 2 chargers can be found,

charging at a quick DC charger is way from free. Amongst world

respondents, these in america and Brazil had been probably the most

keen to pay for 10 minutes (60 miles of vary) of quick charging,

each at $19. For many ICE automobiles, that is costlier than the

gasoline wanted to drive that distance.

A need to cut back greenhouse emissions drives many shoppers to

buy an EV. This objective additionally encourages the substitute of fossil

gasoline burning shopper items – together with heating/cooling methods and

outside backyard gear – with their electric-powered equivalents.

However all of this comes at a value, each at buy and for

recharging. Says Mills, “All-electric every part would not appear to be

achievable for lots of shoppers.”

A number of hurdles should be cleared to attain widespread EV

adoption. Consumers could need to await the subsequent technological

advance, or have considerations about charging time and charger

availability, however in the long run, shopper funds – not engineering –

lead the present shopping for resistance to EVs.

FOR MORE CONSUMER SURVEY INSIGHTS

ALTERNATIVE PROPULSION FORECAST

This text was revealed by S&P International Mobility and never by S&P International Scores, which is a individually managed division of S&P International.

[ad_2]