[ad_1]

Retail marketed stock information for January 2024: S&P

World Mobility delivers the next US new automobile market

insights:

Total trade inventories

Out there new automobile supplier stock listings for the US

market continued to surge as of the top of December. A gentle

upward improve in marketed inventories has continued since

August, and now stands at 2.45 million autos.

After all, gross sales are additionally on the rise. However plotting

year-over-year stock progress, versus year-over-year gross sales

progress, reveals that relative to quantity, inventories are up 30%.

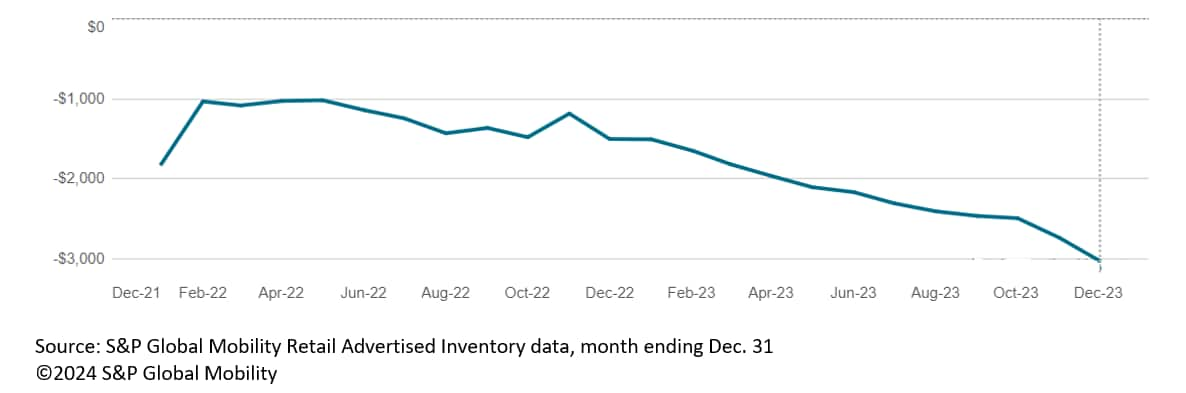

As inventories develop, listed costs and common MSRPs are

dropping – signaling automakers are constructing lower-trim fashions. However

additionally the variety of autos with marketed costs listed beneath

MSRP are rising steadily. On the finish of November, the common

marketed low cost was $2,742; on the finish of December, it had

grown to $3,030 (double the extent of December 2022). And that’s

the marketed value earlier than negotiations or hidden

factory-to-dealer incentives – reminiscent of stair-step quantity bonuses –

are factored in.

Common low cost from MSRP

Which automobile segments are sizzling, and are usually not?

Maybe probably the most flooded main section, relative to gross sales, is

that of full-size pickups (extra on that beneath). In the meantime, the

compact SUV section has probably the most stock – however it’s consistent with

general trade progress – and with registrations buzzing alongside at

about 200,000 per 30 days, the C-SUV section matches the perfect ratio

of two months’ provide.

So far as segments the place one may argue there is not sufficient

stock, the compact automotive, compact pickup, compact luxurious SUV, and

full-size SUV segments are tight on items marketed in supplier

inventories.

Too many full-size pickups?

The complete-size truck is a key revenue generator for the Detroit 3.

However when too many are on showroom flooring, deep discounting occurs

in a rush. On the finish of December, there have been 307,000 full-size

pickups obtainable, up from 229,000 the identical time final 12 months.

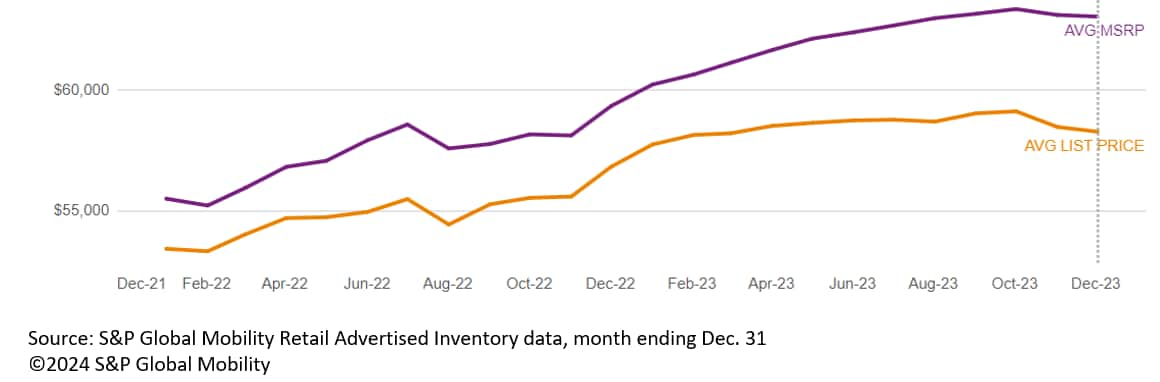

In the meantime, the common MSRP has defied the trade pattern,

growing to $63,000, from $59,300 in December 2022 and $55,400 at

the beginning of 2022. However S&P World Mobility evaluation finds

marketed reductions steadily elevated all by means of 2023, with

$4,740 the present common low cost.

Common MSRP and listing value, full-size pickup truck

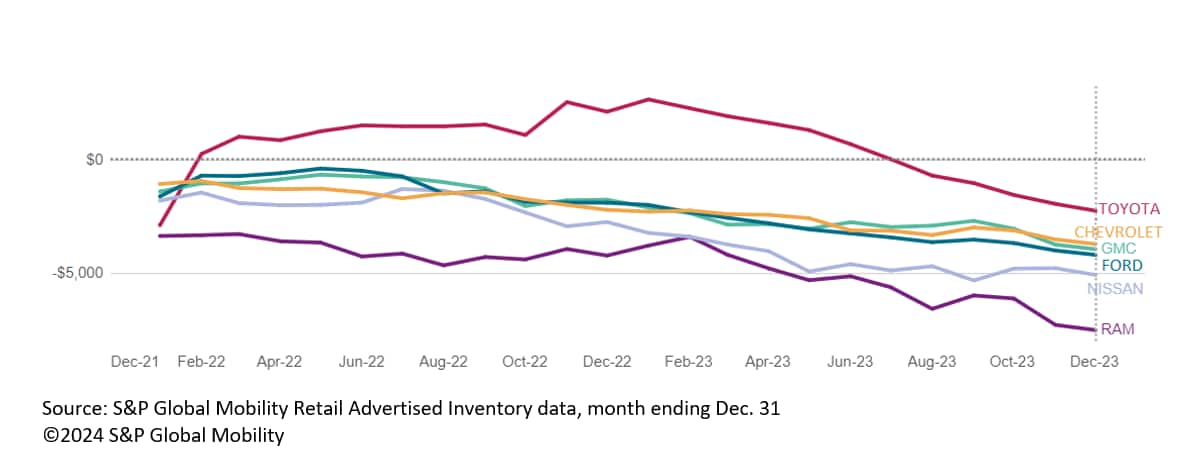

Who’s slashing their massive pickup costs? Ram sellers, with 75% of

dealer-advertised items beneath MSRP. The typical low cost can be

sizably greater than that of the tight pack of Chevrolet, GMC, and

Ford. However even Toyota is discounting. Sizzling take? There may be loads of

stock on the market…offers may very well be coming.

Common low cost from MSRP, full-size pickup truck

The mid-sized pickup battleground looming?

Toyota historically outsells its mid-size truck opponents

handily. <span/>However with

the redesigned 2024 Tacoma in manufacturing unit ramp-up mode, and likewise in

excessive demand, inventories plummeted by means of the fourth quarter. At

the top of December, there have been fewer Tacomas in supplier marketed

stock than Jeep Gladiator or Nissan Frontier. Whereas Toyota

sellers scramble to search out items, would possibly Jeep and Nissan sellers seize

on the chance to conquest shoppers who <span/>cannot wait round for the brand new Tacoma?

Midsize pickup truck inventories

EV inventories stabilizing

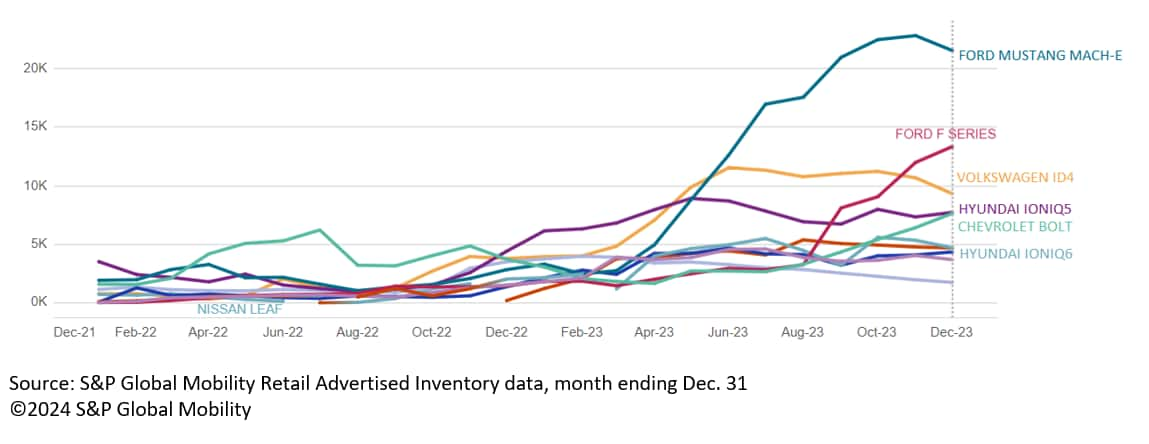

After rising by means of most of 2023, the top of December marked

the primary drop in stock all 12 months for Ford’s Mustang Mach-E. However

with Ford promoting fewer than 5,000 Mach-Es in a month, there nonetheless

is sizable backlog. A more durable story to inform is F-150 Lightning,

which regardless of chopping manufacturing has seen stock develop from 3,200

items in August to 13,000 on the finish of December. At the very least Ford is

now promoting lower-trim variations; the Lightning common MSRP is

roughly $74,000, whereas in December 2022 it carried a median

MSRP of $80,000 plus an $8,000 premium.

Different producers are adjusting their EV inventories to

acknowledge market realities. Most EV inventories – VW ID4 and

Hyundai Ioniq, to call two leaders – have leveled off and are

burbling alongside between 3,000 and 5,000 items for the final quarter

or two, preserving tempo with gross sales. The one actual climber is the

Chevrolet Bolt EV/EUV, however Chevy sellers are also including extra

reductions on its compact EV. The important thing query nonetheless to be answered:

Are we seeing suppressed EV gross sales as a result of an absence of stock, or a

lack of demand?

Electrical automobile inventories

FOR MORE ON INVENTORY DATA AND MARKET

INTELLIGENCE

LIGHT VEHICLE SALES FORECASTING

DOWNLOAD OUR TOP 10 INDUSTRY TRENDS

NEWSLETTER

This text was printed by S&P World Mobility and never by S&P World Rankings, which is a individually managed division of S&P World.

[ad_2]