[ad_1]

Tesla inventory (NASDAQ:TSLA) has seen some strain this 2024, with the electrical car maker seeing a 4.54% drop on Wednesday. With this, TSLA has grow to be the worst-performing inventory within the S&P 500 index this 2024 thus far. It has additionally resulted in CEO Elon Musk, whose web price is intently tied to Tesla inventory, turning into the world’s third-richest particular person by web price.

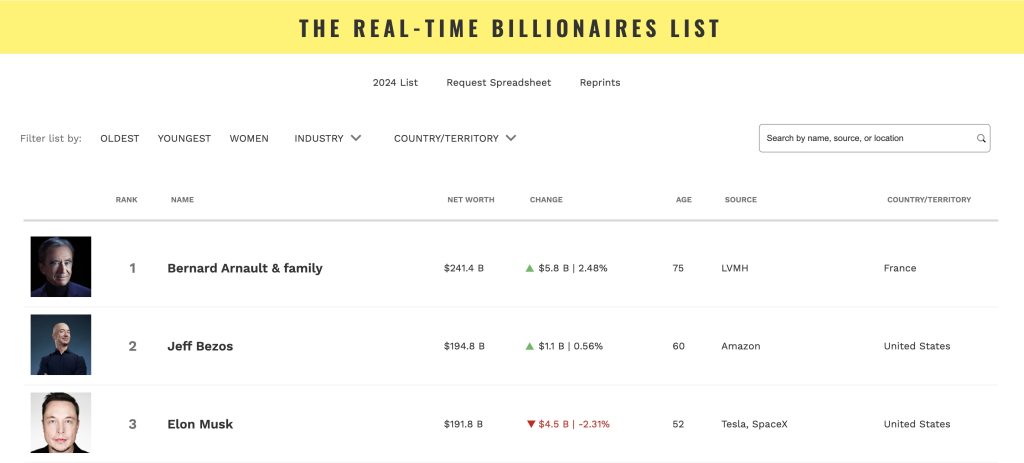

As famous in a Barron’s report, Tesla inventory has been down about 31% year-to-date. Compared, the S&P 500 is up 8% year-to-date. Tesla’s 4.5% slide on Wednesday resulted in Elon Musk’s web price being reduce by $4.5 billion to $191.8 billion, as per Forbes‘ estimates. Which means that Musk’s web price has fallen under Amazon founder Jeff Bezos, whose web price is estimated by Forbes to be $194.8 billion.

Tesla’s latest drop additionally elevated the hole between Musk and LVMH Moët Hennessy Louis Vuitton Chairman and CEO Bernard Arnault, whose web price is estimated at $241.4 billion as of Wednesday’s shut. Arnault is at present listed by Forbes because the world’s richest particular person by web price.

Whereas sentiments surrounding TSLA inventory appear fairly unfavourable for now, the electrical car maker has acquired a vote of confidence from certainly one of its supporters on Wall Road. Wedbush, for one, maintained Tesla’s “Outperform” score and optimistic $315 worth goal. As per analyst Dan Ives, “Now isn’t the time to throw within the towel on Tesla…regardless of the darkish black clouds forming.” Ives additionally famous that “we have now been right here earlier than with Musk/Tesla.”

It ought to be famous that whereas Tesla has lagged behind the S&P 500 within the final six-month, one-year, two-year and three-year durations, its long-term efficiency paints a distinct image. Over the previous 5 years, Tesla’s inventory has soared by practically 800%, rewarding those that purchased in early. Early buyers who held onto their shares for the reason that firm’s IPO in 2010 have seen much more spectacular returns.

Disclosure: I’m lengthy TSLA.

Don’t hesitate to contact us with information ideas. Simply ship a message to simon@teslarati.com to provide us a heads up.

[ad_2]